Louis

-

Posts

12,017 -

Joined

-

Last visited

-

Days Won

10

Content Type

Profiles

Blogs

Forums

Gallery

Events

Posts posted by Louis

-

-

I watched the new Ghostbusters last night....

My views are possibly controversial, so brace yourselves....

I enjoyed it. A lot more than I expected to. It was a very good film. If only they didn't just dismiss the originals out of hand, it would have been perfect.

It was a wasted opportunity. I really didn't like it.I don't remember any river in Logan.

Adult Swim have released an episode of Rick and Morty Season 3

https://vid.me/JBhQ -

Liverpool City Council agreed with the Mayor Recommendations this morning.

-

http://www.liverpoolecho.co.uk/news/liverpool-news/everton-fc-unesco-bramley-moore-12823416

A football stadium given pride of place on the waterfront would enhance, not detract from, the city’s charm.

If UNESCO fails to recognise this – or if, as it suggested in 2012 when it put the city on its “at risk” list, the Liverpool Waters development as a whole is enough to cost the city its status – then so be it.John Burns features in the comments. He's not happy.

-

I've just read that Anthony Ogogo is now registered as blind after fracturing an eye socket, but he wants to continue his boxing career regardless.

-

Apparently he has left, and his successor, a Dave Adams has been appointed, and has also since left.

-

There's a few videos featuring the architect on Youtube.

-

An American journalist asked Bastian Schweinsteiger whether he thinks he can win a World Cup with Chicago Fire at his unveiling press conference.

-

-

That video being embedded on the Liverpool Echo website for every stadium article has become annoying. They've not got much to say and keep referring to the Mayor's report which was published a few days ago.

That academic who posted about the flooding/climate change is a Liverpool fan. He must have been getting dog's abuse, he's took his Twitter account down.

I find myself being skeptical about this stadium, something, somewhere has to go wrong.

-

So Netflix, YouTube and Blu-Rays then?

What was the game you got with it?

-

I'm with you, Romey. I can't wrap my head around it.

America.

America.

-

High-Rise is on Film4 tomorrow night. It's a film based on the JG Ballard book of the same name.

-

-

The great man himself just waffled bollocks about songs that were "radio hits" and others that "should have been hits in my opinion". Tosser.

I liked David Gray's cover of Say Hello, Wave Goodbye. I can't say I know much of Soft Cell other than that and Tainted Love.

I stopped using Sky Go a while ago because of that, I have a PS4 that sits beneath my tv that has Sky Go app installed but Sky want £5 a month for it to be active. It's a rip-off.

-

It wasn't a stupid question! (Loo-iss)

Forvo have it pronounced as Silly.

https://www.howtopronounce.com/cyle-larin/

I could have looked at this though: -

Is it his name prounced 'Silly' or 'Kyle'?

-

One can only hope the developers of this new stadium have undertaken a full climate change risk assessment – or have stocked up on sandbags.

-

I've just read that one of the more known NFL teams, Oakland Raiders are moving from California to Las Vegas because of funds for a new stadium (that looks like the black Power Ranger!).

It's 500 miles away. I saw one fan comment that he'll continue to support the team if they keep the same colours.

-

I won the latest edition in the Worms series the other month along with a plush, keyring and t-shirt. My PC can't play it though.

-

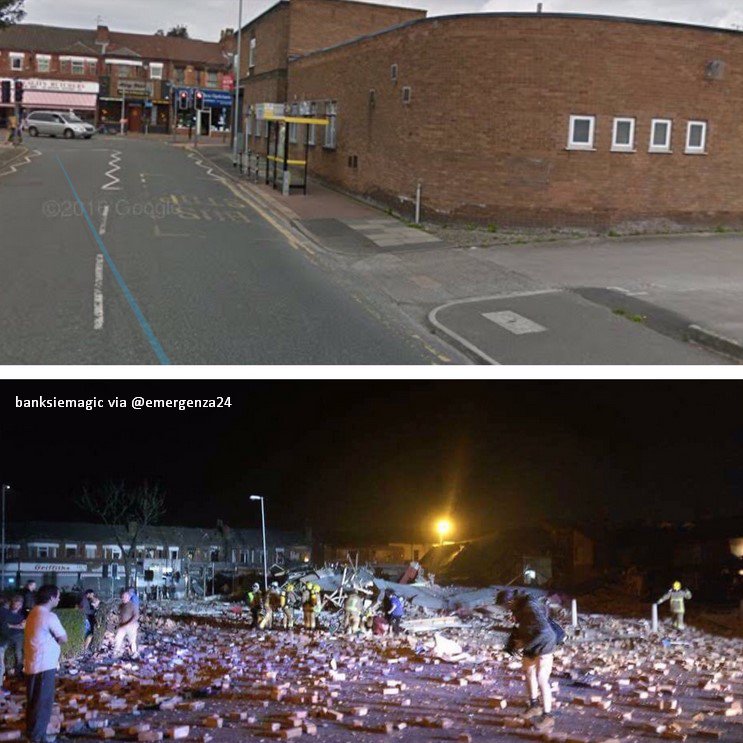

Apparently it was a gas-related explosion, several people have been hospitalised who were in a nearby building.

-

https://neilwblog.com/2017/03/24/the-bramley-moore-conundrum/#comments

For me the more immediate issue is in the proposed cost, “in excess of £300m” and the indicative capacity of 50,000. The Emirates, completed in 2006, cost £390m for 60,000 capacity and they spent tens of millions more in subsequent years to make it more personal and less bland. A 50,000 capacity stadium would be the ninth biggest in the Premier League when complete, assuming Newcastle come up.All this does is slightly close the gap and slightly de-risk the future but we are indulging in wishful thinking if we view it as enough in and of itself to regularly compete at the very top. The silver lining is it should not significantly impair our short-term ability to fund squad improvement. The dark cloud is it would not fully sustain a squad competitive with the top clubs in the future unless we can continue to over-achieve in the transfer market and academy.Spurs is going to cost nearer £800m for 61,000 though this includes significant cost to cope with NFL (retractable pitch, transformable seating) and an unfortunate BREXIT cost impact. Perhaps Moshiri’s business interests at USM will help us access steel at a better price but make no mistake £300m does not buy you an “iconic state of the art venue” as claimed in the announcements. -

Everton's historic Goodison home could be preserved as part of a "vital legacy project" in the area.

The extract from the report I posted above says the site will be used for "health, education, affordable housing and public spaces", it doesn't sound like its being preserved, unless it's going to be a project similar to the one at Highbury.

-

Everton are in talks with Nottingham Forest over a deal for teenage midfielder Brennan Johnson, as the club step up their search for the countrys leading young talents.

Johnson, 15, is the son of former Forest and Ipswich striker David and Everton have seen a number of bids rejected by the Championship club.

Everton want to sign the England under-16 international this season but have been told to pay around £1million, with director of football Steve Walsh now expected to enter negotiations. The deal could go to a tribunal if Everton fail to agree a fee.

-

Executive Summary

The City Council has been working with Everton Football Club (“EFC”) to create a world class, ground-breaking and iconic stadium as a much-needed new home for EFC for the next century. The proposed new Stadium by EFC at Bramley-Moore Dock will be a landmark for the City’s spectacular north Liverpool waterfront and a powerful statement of intent for the Club and the City of Liverpool that will resonate globally.

Terms have been agreed between Peel Land and Property (Ports) Ltd and EFC for EFC’s acquisition of land at Bramley-Moore Dock. The proposed deal between EFC and LCC then envisages Peel granting a 200 year head-lease of the land to the Funder of the new Stadium. The Funder will have the benefit of a lease to a new Council created Special Purpose Vehicle company, which will then sub lease the Stadium to EFC for 40 years. At the end of the 40 year term, EFC will have an option to acquire the leasehold interest in the Stadium.

EFC will fully finance the new Stadium and the Council’s role in this transaction will be to guarantee the repayments to be made by EFC through the lease structure. For this, the Council will receive a significant regular annual fee and a security package to mitigate against risk should EFC default on repayments. This arrangement involves no financial outlay by the Council and structuring the proposed deal in this way will enable EFC to raise the necessary funding to build the new Stadium.

From the City’s perspective, the proposed new Stadium will complement and accelerate the regeneration plans already in place for the north Liverpool area captured within the approved development framework for the Atlantic Corridor, the recently launched vision for the neighbouring 10 Streets Creativity District, and proposals for significant investment in highways and infrastructure, a new Cruise Terminal, an Isle of Man Ferry Terminal and new residential and office developments proposed for Liverpool Waters all within the City’s World Heritage Site and Buffer Zone.

This report seeks authority from Cabinet to acknowledge the prospective and significant regeneration, financial, commercial and economic benefits outlined and to progress the Heads of Terms to final form, subject to satisfactory legal and financial advice.

BackgroundEFC and LCC share a common goal to create a world class, ground-breaking and iconic stadium in a new location that will not only be a landmark for the City, but also bring about significant investment and regeneration benefits to Liverpool.

Initial high-level studies conclude that the full development cost of a new 50,000 seater stadium with associated site specific facilities and infrastructure would be in excess of £300 million.

The specific headline benefits for LCC of a new Stadium can be summarised as follows:

- A significant regular annual fee and income stream for LCC;

- No financial outlay by LCC and structuring the proposed deal in this way will enable EFC to raise the necessary funding from a third party investor to build the new Stadium;

- A one-third uplift in the GVA provided by EFC to the City;

- Endorsement of the City’s ambition and ‘open-for-business’ ethos and a ‘kick-start’ for north Liverpool regeneration including the northern neighbourhood of Liverpool Waters, accelerating development and bringing further outstanding architecture to the waterfront;

- A powerful, best-in-class and much-needed legacy for North Liverpool and L4; and

- Public, community and City Council access to an inspirational sport, leisure, entertainment and recreational facility.

The terms between EFC and LCC envisage Peel granting a 200-year head-lease of the land of the Funder of the new Stadium. The Funder will be the landlord and will have the benefit of a lease to a new City Council created Special Purpose Vehicle, LCC SPV. Then LCC SPV will sub lease the Stadium to EFC. At the end of the 40 year term, EFC will have an option to acquire the leasehold interest in the Stadium from the Funder.

A shadow credit rating exercise will be commissioned from KPMG by EFC, with a scope approved by LCC, which will inform the level of Security fee LCC should charge EFC on the rent of the stadium, in order for the transaction to be deemed market economy investor principle (MEIP) compliant from the perspective of LCC, and therefore compliant with EU State aid rules.

Structuring the proposed deal in this way will enable EFC to raise the necessary funding from a third party funder, to build the new Stadium. The rent paid by EFC to the LCC SPV will be greater than the rent paid by LCC SPV to the Funder and LCC SPV/the Council will then retain the uplift difference between the rents, referred to as a ‘Security fee’, for its part in the transaction. The amount of the Security fee will be determined by the shadow credit rating and benchmarking exercise undertaken by KPMG.

In this way, LCC is securing, not financing, the lease obligations of the wholly owned LCC SPV which in turn will be paid the Security fee and the rent by EFC. The rent will, when capitalised by the Funder, deliver sufficient proceeds to provide a fully funded solution for all the projected Stadium development costs.

It is important to state that there is no financial outlay by LCC to deliver on this deal, unless EFC were to default on their rental repayments, in which case to mitigate against risk of this, there is a security package in place which is in line with third party assessments as three times the level of rental payments.

In assessing the principles of this deal LCC has considered the level of risk and reward and has commissioned external due diligence, engaging professional independent legal and financial advisors appropriately.

There are some risks to LCC and a clear rationale for supporting EFC, both of which are outlined in detail later in this report. It is important to highlight some of the key terms of this deal which oblige EFC to:- Provide a rent which will allow LCC SPV to pay its rent to the Funder and to pay an annual Security fee to LCC, thereby safeguarding the Council from any commercial risk from the venture. The Security fee is anticipated to be in the order of £4M - £5M (based on a projected new Stadium cost in excess of £300M). The margin fee will be determined by the shadow credit rating exercise and taxation advice which is to be completed by KPMG on behalf of EFC and LCC; and

- Provide a full Security Package which is in line with security levels expected in the commercial finance market that will create new ring fenced bank accounts into which certain EFC incomes will be credited to deal with an eventuality of non-payment of rent.

Furthermore, in terms of reward, the economic benefits of the new Stadium alone are forecast to add £9m to the City Region economy annually, creating 100 new additional FTE jobs (in addition to the 370 FTE jobs currently supported by EFC of the Stadium alone). This will both complement and accelerate the wider regeneration plans forecast to deliver at least 5000 new jobs for the area over the next ten years. The Stadium construction is also expected to involve 600 jobs during the build period.

EFC intend to use the Stadium move to facilitate a vital Legacy Project at Goodison Park, delivering health, education, affordable housing and public spaces for the local community which is likely to stimulate further investment in the L4 area and will create social, environmental and economic benefits. Details of this will emerge from EFC in due course.

EFC’s search for a Site

In January 2017, EFC revealed at their AGM that their preferred site for the proposed new Stadium would be Bramley Moore Dock in Liverpool. It is important to highlight the Club’s preference for Bramley Moore Dock and their commitment to invest time, costs and energy into investigating whether this is a viable option. Any decision to proceed with the Stadium at this location will be subject to planning permission following consultation and due planning process supporting this. EFC will be required to submit detail on their site analysis and a Heritage Assessment among other planning requirements.

The Club’s preference for Bramley Moore Dock follows consideration of alternative site analysis, which is briefly outlined below for context.

Prior to this year, in summer 2016, supported by the Council, EFC ruled out plans to build a new ground at Walton Hall Park in Liverpool. Other site options which EFC have previously considered, including redeveloping Goodison Park, have a number of both physical and financial constraints which meant that after careful consideration, these options have been discounted by the Club.

Also, previous options considered the development of sites at Kirkby and Kings Dock respectively. All alternative site option viability work will be detailed and considered as part of the final planning process. The current option to construct a new Stadium on land owned by the private sector, Peel Land and Property (Ports) Ltd at Bramley Moore Dock, has the potential, based on evidence gathered to date and with EFC’s new owners support, to offer the solution to the Stadium issue and be a catalyst for regeneration and economic improvement for the surrounding communities in the north Liverpool Area.

The Rationale for supporting EFC’s proposal

Subject to approvals and final form pieces of advice, there is a strong regeneration case for undertaking this project with EFC on a commercial basis, which benefits both Liverpool City Council and the wider City of Liverpool.

It is also important to consider the rationale for supporting EFC’s potential investment in North Liverpool, as a part of the LCC’s due diligence process and to do this, LCC has noted the history of the Club and its achievements to date.

As above, the economic benefits of the new Stadium alone are forecast to add £9m to the City Region economy annually, creating 100 new additional FTE

jobs (in addition to the 370 FTE jobs currently supported by EFC).

It is further noted by LCC that:- Everton has played in English football’s elite division for a total of 114 out of 118 seasons;

- In the current season, Everton has budgeted to receive c£130m in TV rights fees and future prospects for fees above this amount remain positive. The Premier League has already secured a 13-fold increase in rights for the Chinese market beyond the current term with the current deal in place to 2019. Everton’s own commercial prospects are also positive;

- The Club continues to manage and control costs effectively for player wages. The ratio of player wages to turnover consistently out-performs the Premier League average;

- The Club has also out-performed rivals both by trading players and developing players;

- Maintaining competitiveness in the Premier League results in c£20 million of economic benefit to the City Region, together with 250 full time jobs and 400 part-time match-day jobs currently being provided in north Liverpool; and

- The social benefits for the City that EFC brings through its community programme, Everton in the City (EitC) are well recognised in the City. EitC interacts with over 13,000 individuals each year to help fulfil their aspirations.

Final Heads of Terms between LCC and EFC

Final heads of terms are being negotiated between the parties and final approval of these terms will be the subject of a further report to Cabinet.

It is proposed the key terms of the deal would be as follows:- Peel will grant an agreement for lease and (following receipt of a Satisfactory Planning Permission and other conditions) a 200 year head-lease of the Bramley-Moore Dock land, directly to the funder of the new Stadium (“Funder”) upfront, before the development starts. This is referred to in the heads of terms as the “Head-lease”.

- Two other leases will be granted once the Stadium is built. The Funder will grant a 40 year lease to a wholly-owned subsidiary company of LCC, a “Special Purpose Vehicle” (SPV). This ‘LCC SPV’ would be solely set up for the purposes of this transaction. LCC SPV would take a 40 year under-lease, referred to in the heads of terms as the “Intermediate Lease”.

- With the consent of the Funder, LCC SPV will then have the benefit of a 40 year under-lease (less one day) to EFC. This is referred to in the heads of terms as the “Occupational Lease” and permits EFC to occupy the new Stadium. The Intermediate Lease will be granted subject to, but with the benefit of the Occupational Lease – this means that LCC SPV will become EFC’s direct Landlord.

- At the end of the term of each 40 year Lease, the 200 year lease will subsist and as such, EFC will have the option to purchase the Stadium/Stadium site from the Funder.

The rent under the Occupational Lease (payable by EFC to LCC SPV) will be greater than the rent payable by LCC SPV under the Intermediate Lease (as increased by RPI under the Intermediate Lease), and LCC will through its SPV, retain the difference between the two rents, representing a ‘Security fee’ payable to LCC for being party to the transaction. The Security fee and Rent under this Occupational Lease will be paid annually in advance on 15th August each year.

EFC will provide the annual Security fee and the agreed comprehensive security package to LCC/LCC SPV for the performance of its obligations under the Occupational Lease.

The Security fee will not replace or substitute the potential funds to enable the Stadium development via s106 or s278, which are dictated as due by planning law, guidance and policy.

EFC and LCC have discussed the prospect of entering into a Venue Hire Agreement allowing LCC to use the Stadium at agreed times for agreed purposes, in exchange for the payment of fees. This would be a separate commercial legal agreement between the parties.

EFC will also participate with LCC and other parties as appropriate in the master-planning and development of the wider regeneration of the area and a car parking strategy, therefore maximising the opportunities to create synergies between individual developments, the public and private sector and achieve strategic economic benefits.

LCC Risk and Reward

In brief, the rewards will be as outlined in this report, including the significant regeneration benefits delivered by the new Stadium, which will act as an additional catalyst for development in the North Liverpool area and the annual security fee which the Council will receive, (based on projections) in excess of £4.3M per annum, for its part in the transaction.

The security fee, subject to tax advice, will be reinvested in vital services/projects that support the most vulnerable and or grow the City’s economy.

The risk to the Council lies in the judgement of EFC’s ability to cover their rental commitment and the security fee and to mitigate against this risk, the Council will receive a substantial security package (see below) from EFC to ensure that the rent and security fee will be covered in this eventuality.

What Grinds Your Gears...

in Off Topic Discussion

Posted

I did a night school course (Adobe Illustrator) at Wirral Met and was given one to be able to access the building. It never bothered me. The most stressful thing was the photograph. I hate having my photo taken.